SACS Forms

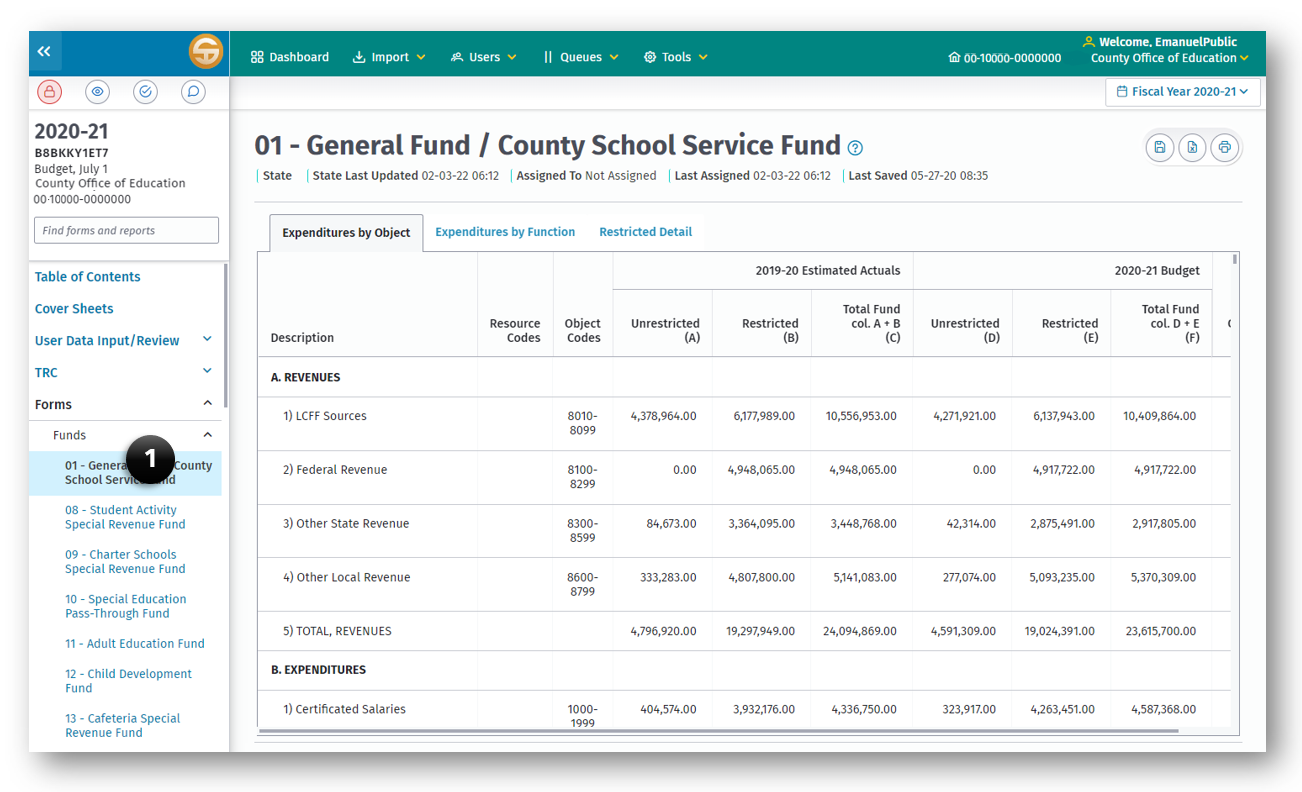

The Forms section of SACS Web System User Guide provides the user with a list of all forms within the submission and the entries entered by form from the LEAs’ financial reporting software prior to importing into SACS. Each form may be accessed after import by clicking on the (1) Forms > Funds link on the left navigation pane.

Some fields on the fund forms are shaded to indicate that data in these fields are not appropriate. We encourage you to review any data displaying in shaded cells to determine whether they are recorded correctly. The individual data records for these amounts display in one or more of the import technical review checks for valid account code combinations. If you believe the data is correct, providing a brief narrative in the TRC explanations to support the use of the accounts helps the CDE evaluate their appropriateness and to determine whether they should be included as valid accounts in the next validation table update.

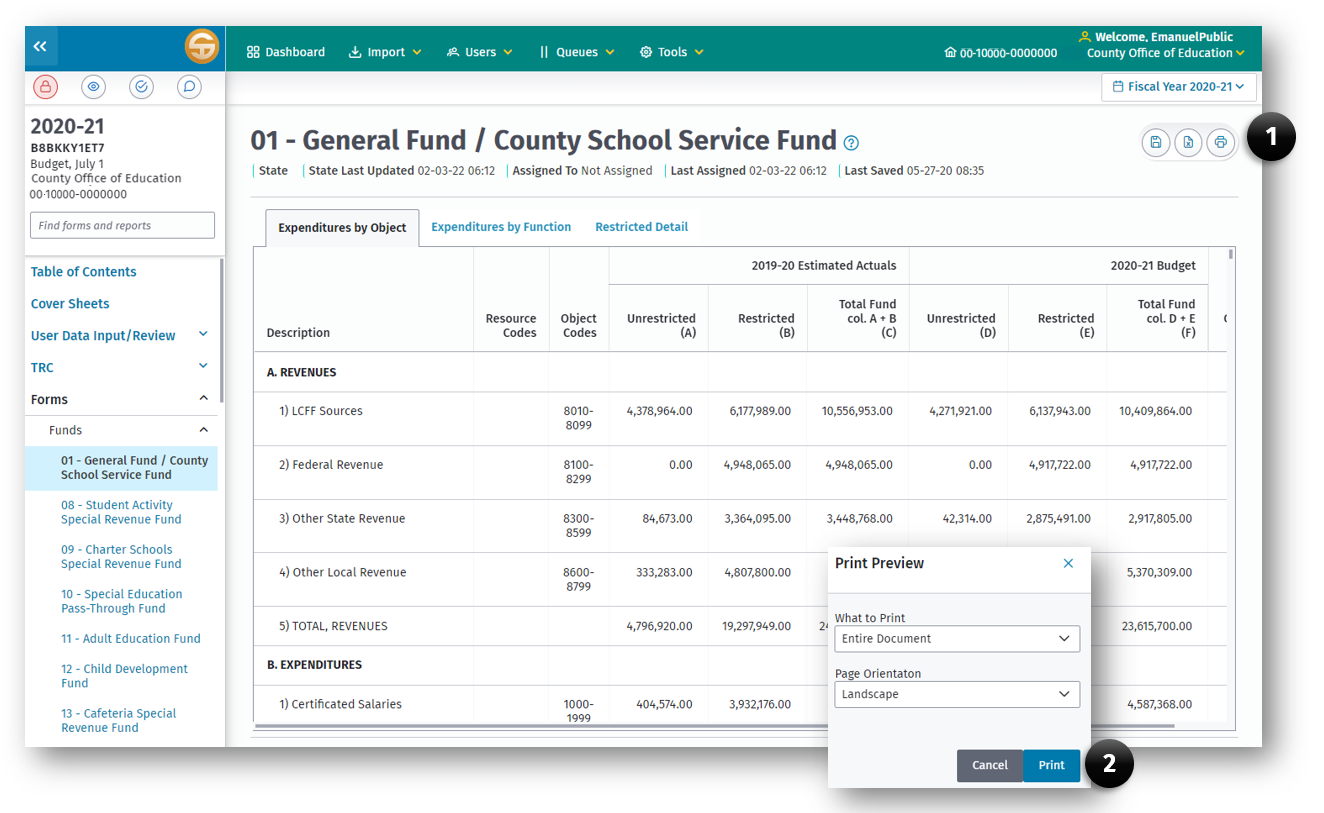

Printing Forms

Printing forms may be done at any time. Click the print button (1) while viewing the form. Some forms may have additional options such as Orientation, or What to Print, in the Print Preview (2) dialog box where a user may choose to print the entire form including all tabs.

Fund Forms

Fund forms may be accessed from a submission using the left navigation panel. The available forms are based on the Reporting Period and LEA Type of the submission.

SUMMARY STATEMENT

The Summary Statement is a detailed description of the information presented in the summarized data of the Expenditures by Object and the Expenditures by Function formats, known as the Summary Statement.

FUND RECONCILIATION

Displays the fund’s assets, deferred outflows, liabilities, deferred inflows, and fund balance at June 30, 2020, for actual data only. Budget information does not display, as asset and liability accounts do not apply for budget data. Data is required for unaudited actuals only (optional for estimated actuals).

NOTE:

Even though the Fund Reconciliation section (Assets, Deferred Outflows of Resources, Liabilities, Deferred Inflows of Resources, and Fund Equity) is optional for estimated actuals in the budget period, the page will print whether the LEA wishes to present it or not. We suggest that those LEAs who do not wish to present it replace the page with a blank that says, “This page intentionally left blank.” No Technical Review Checks are applied to this section in the budget period.

BUDGET, INTERIM AND UNAUDITED ACTUAL FUND FORMS

Budget and Unaudited Actual Forms

There are three different displays in the budget and unaudited actual fund forms:

-

Expenditures by Object - Displays summarized and detailed revenues, expenditures, and other financing sources and uses by major object in the operating statements and includes year end balances in the fund reconciliation.

-

Expenditures by Function - Contains the same data as expenditures by object; however, the expenditures section is displayed by major function rather than object and is only summarized.

-

Restricted Detail - Displays detail of restricted balances by resource.

The fund forms display both actual and budget data.

Interim Fund Forms

Forms 01i Through 73i—Statement of Revenues, Expenditures, and Changes in Fund Balance.

The General Fund CSSF and any other funds projecting a negative fund balance are required for the interim periods.

Description of data types used in the interim periods:

-

Original Budget is the current year budget adopted on or before July 1, or the revised budget of an LEA whose original July 1 budget was disapproved by its reviewing agency.

-

Board Approved Operating Budget is the latest approved operating budget. If the governing board has not approved any amendments to the budget, the Board Approved Operating Budget will be the same as the Original Budget.

-

Actuals to Date represents the actual revenue received and expenditures paid as of the close of the interim reporting period.

-

Projected Year Totals represents the total projected revenue, expenditures, and other activities for the entire year. It includes all required year-end accruals of revenues and expenditures.

There are four worksheets in the General Fund/CSSF interim report:

1. Unrestricted – Data for resources 0000 through 1999 are displayed in the Unrestricted worksheet

2. Restricted – Data for resources 2000 through 9999 are displayed in the Restricted worksheet

3. Combined Unrestricted/Restricted – The Unrestricted and Restricted worksheets are summed in the Unrestricted/Restricted worksheet

4. Restricted Detail – Detail of restricted balances by resource are displayed in the Restricted Detail worksheet

FUND DESCRIPTIONS

The following information is provided as an augmentation to the information in the CSAM. If a fund is not discussed here, there is no information/clarification in addition to what is in CSAM. Please refer to CSAM for specific descriptions and directions regarding the funds.

SUPPLEMENTAL FORMS

The supplemental data forms are accessed under the Forms menu option from the Left Navigation Menu within the submission and are available based on the LEA type and reporting period. The supplemental data forms are designed to provide required certifications, permit entry of specific information relating to certain programs, and demonstrate compliance with particular requirements.

Supplemental forms are required, optional or not applicable based on the current reporting period, LEA type, and the rules required to submit data for the form. This is represented by Appendix A - Form Reporting Period Matrix.

Since similarities exist among the forms, listed below are general pointers to enhance the report processing. Unlike fund data, supplemental data can be entered, modified, or deleted directly in the reports that allow data entry.

-

Entering Data

Fields shaded tan allow key entry. To record an entry, press the Enter or Tab key. Pressing the Enter key does not cause the cursor to move to another field. Pressing the Tab key moves the cursor horizontally, then vertically, to the next entry field. Both methods bypass any extracted, calculated, or locked fields. The arrow keys move the cursor to the next or previous field (entry, imported, calculated, or locked fields) in the form. -

Entering Cents

Most dollar values display in the SACS Web System with two decimal places; whole numbers will automatically have .00 added to them. -

Inserting/Editing Data

Clicking on a field allows the entry to be edited but does not replace the existing data. -

Typeover

Double clicking on a field allows new data to be entered to replace the existing data. This is the typeover mode. -

Deleting Data—Entered Values

Double clicking on a field and pressing the Delete key clears data in that field.

CAUTION: Do not use the space bar to clear an entry; it causes problems in the database and errors in the TRC.

-

Deleting Data—Extracted Values

To clear a cell where the value is extracted but can be overwritten (for example, the CASH form), enter a zero. If extracted cells are cleared by pressing the Delete key rather than entering zero, the original value may be re‑extracted when the form is re‑opened, overwriting the deletion every time the form is re‑opened. -

Computations

The SACS Web System automatically recalculates the forms with input fields on screen whenever a user changes the information in a cell and moves to another cell. -

Negative Amounts

Press the “-“ key before entering a negative number.

The following supplemental data forms are fully extracted from the database (similar to the fund forms), and need only be opened, reviewed, and printed if desired:

- Program Cost Report (Form PCR)

- Summary of Interfund Activities – Actuals (Form SIAA)/Budget (Form SIAB)/Interim (Form SIAI)

NOTE: As with the fund forms, invalid account codes in the LEA financial system export may result in unexpected results in supplemental data forms containing extracted general ledger data. Clear all fatal import and general ledger technical review checks before completing the supplemental data forms.

BUDGET & UNAUDITED ACTUAL SUPPLEMENTAL FORMS

INTERIM SUPPLEMENTAL FORMS

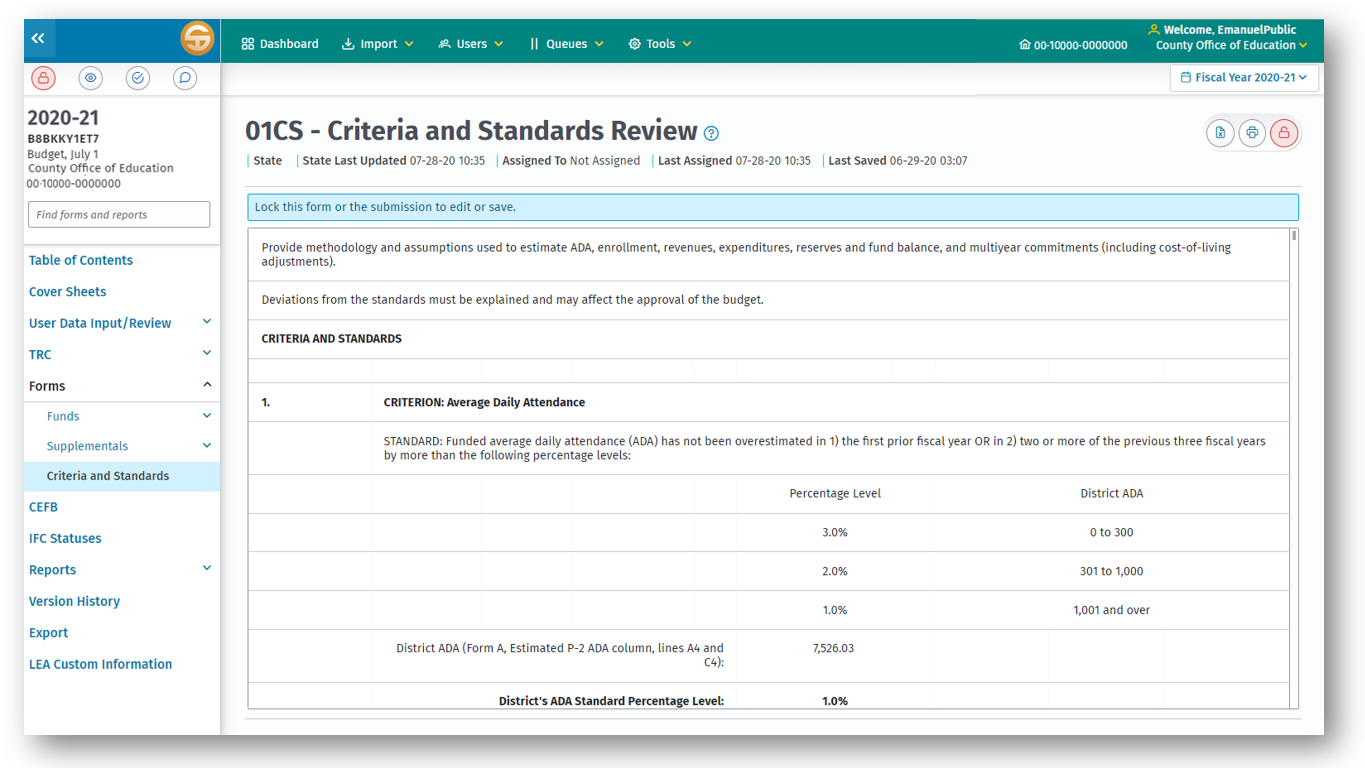

Criteria and Standards

NOTE REGARDING REPORTING PERIOD REFERENCES

-

While this SACS2022ALL Software User Guide continues to contain information for all reporting periods, only the 2021–22 unaudited actuals reporting period is available for use in the SACS2022ALL software. In this user guide, any updates to budget and interim reporting period references are provided for informational purposes only, to keep the user guide whole. The SACS2022ALL Software User Guide What’s New changes described for 2022–23 budget and interim reporting periods are, or will be, included in the new SACS Web-based Financial Reporting System (SACS Web System).

-

The 2022–23 budget reporting period is available for use in, and the 2022–23 interim reporting periods will be available for use in, the new SACS Web System. For additional information regarding the SACS Web System, please visit the CDE’s Financial Reporting web page at https://www.cde.ca.gov/fg/sf/fr/#sacswebsystem.

-

CDE will no longer publish the SACS desktop software after this SACS2022ALL release. All SACS financial reporting for 2022–23 and subsequent years will be done through the SACS Web System.

LEAs are required (EC Section 33129) to use the Criteria and Standards adopted by the State Board of Education (SBE) in developing their budgets and managing their expenditures. In addition, Criteria and Standards are used to monitor the fiscal stability of LEAs. After all other forms have been prepared and the data is validated through the Technical Review Checklist, the Criteria and Standards Review form (Form 01CS for budgets and Form 01CSI for interims) must be completed. Form 01CS (01CSI) is accessed from the Forms menu option on the left Navigation pane and automatically opens upon selecting Criteria and Standards.

The Criteria and Standards Review form has three sections: Criteria and Standards, Supplemental Information, and Additional Fiscal Indicators. There are ten criteria and standards, ten supplemental information items (nine in the interim periods), and nine additional fiscal indicators. For COEs, there is the same number of supplemental information items, but there are only eight criteria and standards and eight additional fiscal indicators. All three sections must be completed; only general fund [CSSF] data must be included unless otherwise indicated on the form. Where possible, data is extracted and preloaded from various sources into the Criteria and Standards Review Form. Some data must be manually input.

ASSUMPTIONS FOR BUDGET PLANNING AND MANAGEMENT

School districts and county offices prepare their budget and interim reports-based available assumptions. The CDE strongly encourages districts and county offices to document and include those assumptions in the budget and interim packages submitted for approval. Further, the reviewing agency may require this information as it is crucial in assessing the reasonableness and viability of the budgets and the LEA’s fiscal stability. It allows the reviewing agencies to better understand the budget and interim reports and to make more informed determinations as to whether they are in compliance with the state-adopted Criteria and Standards for fiscal solvency. At a minimum, the following assumptions must be identified and included in the budget and interim packages. Additionally, individual reviewing agencies may require more specific, or slightly different, information.

NOTE: The following assumptions are geared toward budget preparation. Interim report assumptions must cover similar information with a focus on explaining material differences in the items between the current and prior periods.

- General Fund[CSSF]—Revenues

- General Fund[CSSF]—Expenditures

- Other Funds—Revenues, Expenditures, or Transfers

DATA SOURCES FOR THE CRITERIA AND STANDARDS REVIEW

To ensure accuracy in the Criteria and Standards Review form, prior to completion of Form 01CS (01CSI), general ledger data must be imported or key entered in the User Data Input/Review screen, the general fund[CSSF] Form 01 (01I) must be opened and saved, and key supplemental forms must be completed.

Learn more about C&S Data Sources

Overview of the Criteria and Standards Sections

- FORM 01CS—CRITERIA AND STANDARDS REVIEW—BUDGET

- FORM 01CSI—CRITERIA AND STANDARDS REVIEW—INTERIM

- TECHNICAL REVIEW CHECKS (TRCs) FOR THE CRITERIA AND STANDARDS

SUMMARIZING THE CRITERIA AND STANDARDS REVIEW

For each of the criteria and standards, supplemental information items, and additional fiscal indicators, the SACS Web System determines, based on the information provided whether the standards/items have been met (indicated as Met or Not Met) or are outside of allowable limits or what might be considered desirable conditions (indicated as Yes or No). These results are then summarized on the certification form (Form CB [CI]) for information and review.

Tips for Completing the Criteria and Standards Review Form

- In the Criteria and Standards Review form, general fund[CSSF] data is extracted from the general ledger data and from the saved Form 01 (01I). Therefore, in addition to importing general fund[CSSF] data, Form 01 (01I) must be opened and saved before completing the Criteria and Standards Review form.

NOTE: Since fund data is extracted from general ledger data, as well as from Form 01 (01I), invalid codes and combinations may cause the extracted data to differ from the data displayed in the funds. It is recommended that invalid codes and combinations be corrected prior to completing the Criteria and Standards Review form. Run the Import technical review checks to identify invalid codes and combinations.

-

After opening the Criteria and Standards Review form for the first time (at which time the software will extract data preloaded by CDE, plus fund and supplemental data), you may wish to print the form to use as a tool for gathering data to complete it.

-

To make data entry and moving around in the form easier, you may wish to refer to the Tips for Using the SACS Software section of this user guide. We recommend using the Tab key to move throughout the form. The Enter key is disabled in the Criteria and Standards Review form because of the columnar structure of the form.

CAUTION: Please read each item in the Criteria and Standards Review form carefully. The type of data being gathered, such as Funded ADA or P-2 ADA, may change from question to question.

-

Detailed explanations are required within the Criteria and Standards Review form when the criteria have not been met or supplemental information items indicate a need for additional information.

-

NOTE: The status of each criterion and applicable supplemental information items will default to Not Met until applicable data has been imported, saved, and/or entered. Enter a zero in any of the cells that are not applicable.

-

After you have completed all of the applicable sections and have provided required explanations, such as for criteria with a Not Met status, save and print the form before closing.

NAVIGATING AND EDITING FORMS

Since similarities exist among the forms, listed below are general pointers to enhance the report processing. Unlike fund data, supplemental data can be entered, modified, or deleted directly in the reports that allow data entry.