Budget & Unaudited Actuals Supplemental Forms

The supplemental data forms are accessed under the Forms menu option from the Left Navigation Menu within the submission and are available based on the LEA type and reporting period. The supplemental data forms are designed to provide required certifications, permit entry of specific information relating to certain programs, and demonstrate compliance with particular requirements.

Supplemental forms are required, optional or not applicable based on the current reporting period, LEA type, and the rules required to submit data for the form. This is represented by Appendix A - Form Reporting Period Matrix.

BUDGET & UNAUDITED ACTUAL SUPPLEMENTAL DATA FORMS

Form A—Average Daily Attendance (not applicable for JPAs)

The Average Daily Attendance (ADA) form, Form A, displays the ADA data for the Second Period (P-2) Report of Attendance (July 1–April 15); for the Annual Report of Attendance (July 1–June 30); and for the Local Control Funding Formula (LCFF) funded ADA. The data is key entered and should come from the Principal Apportionment Data Collection data entry screens and Principal Apportionment funding exhibits, as applicable.

Form A contains three separate worksheets (tabs) for use in reporting School District ADA, County Office of Education ADA, and Charter School ADA.

Tab A—School District ADA

Lines A1-A3 – Total District Regular ADA

Regular ADA includes Opportunity Classes, Home and Hospital, Special Day Class, Continuation Education, Special Education, NPS/LCI and Extended Year, and Community Day School ADA. Necessary Small School ADA is included in this total.

Estimated/Unaudited Actuals Periods:

-

Enter the P-2 Principal Apportionment attendance figure reported in the total column of Line A-6 of the Attendance School District, Attendance Supplement School District, Attendance Basic Aid Choice/Court Ordered Voluntary Pupils Transfer, or Basic Aid Open Enrollment data entry screens.

-

Enter the Annual Principal Apportionment attendance figure reported in the total column of Line A-6 of the Attendance School District, Attendance Supplement School District, Attendance Basic Aid Choice/Court Ordered Voluntary Pupils Transfer, or Basic Aid Open Enrollment data entry screens.

-

Enter the ADA used for the LCFF entitlement calculation (i.e., funding ADA as identified on the Principal Apportionment funding exhibits).

Budget Period:

- Estimate and enter the ADA to be used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA to be used for the LCFF calculation.

Lines A5a-A5f – District Funded County Program ADA

Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figures reported in the total column of Lines A-1 through A-6 of the Attendance Funded County Program ADA data entry screen.

- Enter the Annual Principal Apportionment attendance figure reported in the total column of Lines A-1 through A-6 of the Attendance Funded County Program ADA data entry screens.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the School District ADA funding exhibit.

Budget Period:

- Estimate and enter the ADA to be used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA to be used for the LCFF calculation.

Line A7 – Adults in Correctional Facilities

Enter the ADA from Line A-1 of the Adults in Correctional Facilities data entry screen for applicable periods.

Line A8 – Charter School ADA

This line does not allow key entry. Use Tab C, Charter School ADA, to report ADA for charter schools that report their SACS financial data in the authorizing LEA’s Fund 01, 09, or 62.

Tab B—County Office of Education ADA

Lines B1a-B1c – County Program Alternative Education Grant ADA

These lines represent the ADA for children attending juvenile court schools operated by the county office of education, and students that attend other schools operated by the county office, such as the County Community Schools or special education classes and centers, who are enrolled pursuant to EC Section 2574(c)(4)(A).

Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figures reported in the total column of Lines A-1 through A-3 of the Attendance COE data entry screen.

- Enter the Annual Principal Apportionment attendance figures reported in the total column of Lines A-1 through A-3 of the Attendance COE data entry screen.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the County LCFF Calculation exhibit.

Budget Period:

- Estimate and enter the ADA to be used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA to be used for the LCFF calculation.

Lines B2a-B2f – District Funded County Program ADA

These lines represent the ADA for children attending programs funded through their districts of residence, operated by the county office of education, that do not meet the requirements for funding under the county office Alternative Education Grant. This ADA is the combined total for all applicable districts of residence. The county office would not also report this ADA on Tab A, School District ADA. Tab A is completed by each district of residence to report its own District Funded County Program ADA.

Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figures reported in the total column of Lines A-1 through A-6 of the Attendance District Funded County Programs data entry screen.

- Enter the Annual Principal Apportionment attendance figures reported in the total column of Lines A-1 through A-6 of the Attendance District Funded County Programs data entry screens.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the School District ADA funding exhibit for each applicable school district of residence.

Budget Period:

- Estimate and enter the ADA to be used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA to be used for the LCFF calculation.

Line B4 – Adults in Correctional Facilities

Enter the ADA from Line A-1 of the Adults in Correctional Facilities data entry screen for applicable periods.

Line B5 – County Operations Grant ADA

The County Operations Grant ADA total is compiled by the Principal Apportionment Office and is displayed in the County Operations Grant funding exhibit.

Line B6 – Charter School ADA

This line does not allow key entry. Use Tab C, Charter School ADA, to report ADA for charter schools that report their SACS financial data in the authorizing LEA’s Fund 01, 09, or 62.

Tab C—Charter School ADA

This tab is used to enter ADA for either of the following:

- Charter schools reporting in SACS separately from their authorizing LEAs use this tab exclusively to enter their own ADA.

- Districts and county offices of education use this tab in conjunction with the School District tab or County Office of Education tab to enter ADA for charter schools that report their financial data in the district or county office’s Funds 01, 09, or 62.

As necessitated for ADA extraction into the district Criteria and Standards, and district form MYP, the Charter School worksheet of Form A is divided into two separate sections. Only charter school ADA corresponding to SACS financial data reported in Fund 01 should be entered into the first section. Charter school ADA corresponding to SACS financial data reported in Fund 09 or Fund 62 should be entered into the second section.

Charter School ADA Corresponding to SACS Financial Data Reported in Fund 01:

Line C1 – Total Charter School Regular ADA

Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figure reported in the total column for Regular ADA of Line J-5 of the Attendance Charter School and sum of Lines H-6 for all tracks of the Attendance Charter School-All Charter District.

- Enter the Annual Principal Apportionment attendance figure reported in the total column for Regular ADA of Line J-5 of the Attendance Charter School and sum of Lines H-6 for all tracks of the Attendance Charter School-All Charter District.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the Charter School LCFF Calculation funding exhibit.

Budget Period:

- Estimate and enter the ADA used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA used for the LCFF calculation.

Lines C2a-C2c – Charter School County Program Alternative Education ADA

These lines represent the ADA for students in charter-operated juvenile court schools and students in other county programs operated by charter schools, who are enrolled pursuant to EC Section 2574(c)(4)(A). The ADA is funded through the county office.

Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figure reported in the total column of the applicable lines on the Attendance County Program Charter School data entry screen.

- Enter the Annual Principal Apportionment attendance figure reported in the total column of the applicable lines on the Attendance County Program Charter School data entry screen.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the County LCFF Calculation funding exhibit.

Budget Period:

- Estimate and enter the ADA used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA used for the LCFF calculation.

Lines C3a-C3e – Charter School Funded County Program ADA

These lines represent the ADA that does not meet the requirements for funding under the county office Alternative Education Grant for Charter School children attending county programs. This ADA is funded through the charter school. Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figures reported in the total columns of the applicable lines on the Attendance County Program Charter School data entry screen.

- Enter the Annual Principal Apportionment attendance figures reported in the total column of the applicable lines on the Attendance County Program Charter School data entry screen.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the Charter School LCFF Calculation exhibit.

Budget Period:

- Estimate and enter the ADA to be used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA to be used for the LCFF calculation.

Charter School ADA Corresponding to SACS Financial Data Reported in Fund 09 or Fund 62:

Line C5 – Total Charter School Regular ADA

Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figure reported in the total column for Regular ADA of Line J-5 of the Attendance Charter School and sum of Lines H-6 for all tracks of the Attendance Charter School-All Charter District, or Basic Aid Supplement Charter School data entry screens.

- Enter the Annual Principal Apportionment attendance figure reported in the total column for Regular ADA of Line J-5 of the Attendance Charter School and sum of Lines H-6 for all tracks of the Attendance Charter School-All Charter District.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the Charter School LCFF Calculation exhibit.

Budget Period:

- Estimate and enter the ADA used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA used for the LCFF calculation.

Lines C6a-C6c – Charter School County Program Alternative Education ADA

These lines represent the ADA for students in charter-operated juvenile court schools and students in other county programs operated by charter schools, who are enrolled pursuant to EC Section 2574(c)(4)(A). The ADA is funded through the county office.

Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figure reported in the total column of the applicable lines on the Attendance County Program Charter School data entry screen.

- Enter the Annual Principal Apportionment attendance figure reported in the total column of the applicable lines on the Attendance County Program Charter School data entry screen.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the County LCFF Calculation exhibit.

Budget Period:

- Estimate and enter the ADA used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA used for the LCFF calculation.

Lines C7a-C7e – Charter School Funded County Program ADA

These lines represent the ADA that does not meet the requirements for funding under the county office Alternative Education Grant for charter school students attending county programs funded through the charter school.

Estimated/Unaudited Actuals Periods:

- Enter the P-2 Principal Apportionment attendance figures reported in the total columns of the applicable lines on the Attendance County Program Charter School data entry screen.

- Enter the Annual Principal Apportionment attendance figures reported in the total column of the applicable lines on the Attendance County Program Charter School data entry screen.

- Enter the ADA used for the LCFF entitlement calculation, which can be found on the Charter School LCFF Calculation exhibit.

Budget Period:

- Estimate and enter the ADA to be used for the P-2 and the Annual attendance reporting.

- Estimate and enter the ADA to be used for the LCFF calculation.

Form ASSET—Schedule of Capital Assets

Form ASSET is used to report changes in the balances of capital assets and accumulated depreciation for the fiscal year. This form closely resembles the note disclosure for capital assets required by GASB Statement 34. It is divided into two sections: Governmental Activities and Business-Type Activities. Capital assets used in general governmental activities accounted for in governmental funds are reported in the Governmental Activities section. Capital assets used in business-type activities accounted for in enterprise funds are reported in the Business-Type Activities section. Each of these sections is further divided into capital assets that are not being depreciated, and capital assets that are being depreciated.

The schedule of capital assets is completed using extracted, entered, and calculated data. The columns on this form are completed as follows:

Unaudited Balance July 1

Capital asset ending balances reported in Form ASSET in the prior year are extracted from the database into the Unaudited Balance July 1 (beginning balance) column. If capital assets were not reported in Form ASSET in the prior year and, therefore, zeros appear in the beginning balance column, report any beginning balances in the Audit Adjustments/Restatements column. Beginning balances for accumulated depreciation are input as negative numbers.

NOTE: Manual input is not allowed in this beginning balance column.

Audit Adjustments/Restatements Column

Adjustments or restatements that increase the unaudited July 1 balances of capital assets are input as positive numbers. Adjustments or restatements that decrease the unaudited July 1 balances of capital assets are input as negative numbers.

Adjustments or restatements that increase the unaudited July 1 balances of accumulated depreciation are input as negative numbers. Adjustments or restatements that decrease the unaudited July 1 balances of accumulated depreciation are input as positive numbers.

Audited Balance July 1

Amounts are calculated beginning with Unaudited Balance July 1, plus Audit Adjustments/Restatements.

Increases Column

Increases in capital assets are input as positive numbers. Increases in accumulated depreciation are input as negative numbers. Amounts in the Increases column are added to the amounts in the Audited Balance July 1 column to arrive at the Ending Balance June 30 column.

For example, the cost of equipment acquired during the fiscal year is recorded as a positive number on the line for Capital Assets Being Depreciated: Equipment, in the Increases column. The increase to accumulated depreciation on equipment for the fiscal year is recorded as a negative number on the line for Accumulated Depreciation for Equipment, in the Increases column.

Decreases Column

Decreases in capital assets are input as positive numbers. Decreases in accumulated depreciation are input as negative numbers. The amounts in the Decreases column are subtracted from the amounts in the Audited Balance July 1 column to arrive at the Ending Balance June 30 column.

For example, the original cost of equipment that is sold or otherwise disposed of is removed from the aggregate balance of equipment and is recorded as a positive number on the line for Capital Assets Being Depreciated: Equipment, in the Decreases column. The accumulated depreciation associated with the equipment disposed of is removed from the aggregate accumulated depreciation balance for equipment and is recorded as a negative number on the line for Accumulated Depreciation for Equipment, in the Decreases column.

Ending Balance June 30 Amounts are calculated beginning with the Audited Balance July 1, plus Increases, minus Decreases.

Amounts in the Ending Balance June 30 column should be verified to ensure that adjustments, increases, and decreases to capital assets have been input correctly and that ending balances agree to asset schedules and financial statements. Ending balances are saved by CDE and used for external data reporting purposes and are extracted into the subsequent year’s Form ASSET as beginning balances.

Form CA—Unaudited Actuals Certification

Form CA is the official signature page for the unaudited actuals report submission. For JPAs only, it includes a section to request an indirect cost rate. If JPAs do not indicate an indirect cost rate is requested, an exception will display upon running the TRC.

In addition to the certification page, Form CA also has a page titled Summary of Unaudited Actual Data Submission (not applicable for charter schools). It provides a summary of critical data elements that may have fiscal implications on the next year’s apportionments or recovery of indirect costs. Please verify the accuracy of this data prior to filing the unaudited actuals financial reports.

Form CASH—Cashflow Worksheet

Form CASH is optional for the budget period, although a cashflow analysis at budget adoption cycle is recommended. Refer to the Interim Form CASH for information on completing this form.

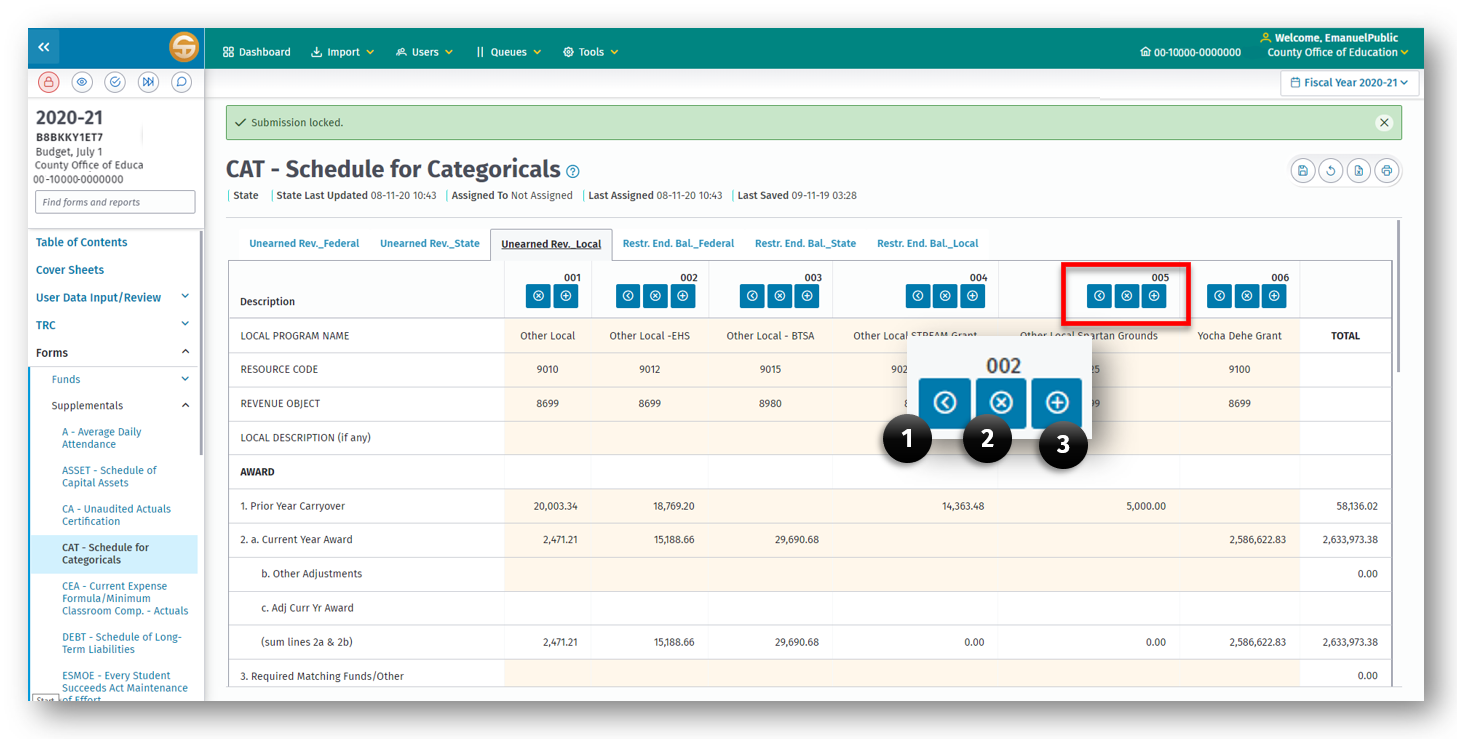

Form CAT—Schedule for Categoricals

Form CAT is an optional form designed to assist in the determination of the correct amount of unused grant award (carryover), accounts payable, accounts receivable, unearned revenue, and/or restricted ending balance at the end of the fiscal year for all federal, state, and local categorical programs for which the district [COE] is responsible, regardless of the funding source.

The Form is required, optional, or not applicable based on the current reporting period and the rules required to submit data for the form. This is represented by Appendix A - Form Reporting Period Matrix.

The CAT form allows for the addition of multiple columns via the buttons above each column.

-

Shifts the column to the left from its current position

-

Deletes the column

-

Creates a new column

Information on whether a particular state or federal program administered by the CDE is accounted for as subject to deferral of unearned revenue (U) or subject to restricted ending balance (F) is available through the SACS Query, located on the CDE Standardized Account Code Structure (SACS) web page:

https://www.cde.ca.gov/fg/ac/ac/

Select either the PCA Number Query or SACS Resource Code Query and enter the desired search criteria to access program information from the SACS Query database.

Categorical Programs Subject to Deferral of Unearned Revenues

Categorical programs are classified as subject to deferral of unearned revenues when their revenue is earned at the time qualifying expenditures are made. In general, an expenditure is the prime factor for determining grant eligibility and revenue is recognized when the qualifying expenditure is made. Revenue received but not expended by the end of the fiscal year must be reported as unearned revenue.

The following rules apply to accounting for these programs:

- The revenue is initially recognized when cash is received.

- At the end of the year, when the total revenues received exceed the total donor-authorized expenditures, the difference is recorded as unearned revenue. Unearned revenue is revenue that has been received but has not been earned. The total expenditures used in this calculation may not exceed the program award.

- At the end of the year, when the total revenues received are less than the total donor-authorized expenditures, the difference is recorded as an accounts receivable. The total expenditures used in this calculation may not exceed the program award.

- Unused program award revenue (carryover) is the difference between the total program award and the total donor-authorized expenditures for the year. The amount of any unused program award revenue (carryover) is not recorded in the books but is added to the amount of the program award for the subsequent year to determine the total revenue available. The unused program award revenue should not be recorded as an accounts receivable because it is not earned.

Column Headings

Provide for each program the official name of the program, the five-digit number from the Catalog of Federal Domestic Assistance (federal programs only), the resource code used to record the program, the revenue object, and the local description of the program, if any.

AWARD

Line 1 - Prior Year Carryover

Report the amount of the prior year’s unused award, which may be expended in the current year. Include any adjustments made to the prior year’s award. This amount includes any unearned revenue deferred from the prior year.

Line 2a - Current Year Award

Report the amount of the current year’s award. This amount should agree with the award letter or document from the grantor agency.

Line 2b Federal Transferability (ESSA) (Object 8990) (FOR FEDERALLY FUNDED PROGRAMS SUBJECT TO DEFERRAL OF UNEARNED REVENUES ONLY)

Report transfers of federal funds made using Object 8990, Contributions from Restricted Revenues, pursuant to Section 5103(b) of Part A of Title V of the Elementary and Secondary Education Act (ESEA), as amended by the Every Student Succeeds Act (ESSA).

Lines 2b - State/Local - 2c Federal Other Adjustments

Report any other adjustments made to the grant award.

Lines 2c - State/2d Federal Adjusted Current Year Award

For State and Local Programs, the sum of the Current Year Award (Line Local 2a) plus Other Adjustments (Line 2b). For federal programs, the sum of the Current Year Award (Line 2a) plus Transferability (Line 2b) plus Other Adjustments (Line 2c).

Line 3 - Required Matching Funds/Other

Report the amount of any required matching funds as indicated in the award letter or document. When there is no match required, enter zero. Exclude “in-kind” matching. Report other income such as interest earned by and restricted to specific programs. Exclude contributions made using Object 8980, Contributions from Unrestricted Revenues.

Line 4 - Federal Total Available Award

Federal

The sum of the Prior Year Carryover (Line 1) plus the Adjusted Current Year Award (Line 2d) plus the Required Matching Funds/Other (Line 3). This amount represents the total available to be spent this year.

State/Local

The sum of the Prior Year Carryover (Line 1) plus the Adjusted Current Year Award (Line 2c) plus the Required Matching Funds/Other (Line 3). This amount represents the total available to be spent this year.

REVENUES

Line 5 - Unearned Revenue Deferred from Prior Year

Report the amount of unearned revenue recorded in the prior year.

Line 6 - Cash Received in Current Year

Report the amount of cash received during the current year. Include transfers made using Object 8990; exclude transfers made using Object 8980. Include the amount of any cash received from the prior year’s award that was not recorded as an account receivable in the prior year. When adjustments were made to the current year’s revenue accounts as a result of prior year’s accounts receivable and accounts payable, report these amounts too.

Line 7 - Contributed Matching Funds

Report the amount of matching funds contributed by the district[COE]. Exclude “in kind” matching.

Line 8 - Total Available

The sum of the Unearned Revenue Deferred from Prior Year (Line 5) plus the Cash Received in Current Year (Line 6) plus the Contributed Matching Funds (Line 7).

EXPENDITURES

Line 9 - Donor-Authorized Expenditures

Report the sum of the direct, direct support, and indirect costs approved by the grantor agency; include expenditures of required matching funds. The Donor-Authorized Expenditures may not exceed the Total Available Award (Line 4).

Line 10 - Non Donor-Authorized Expenditures

Report expenditures not authorized by the grantor agency, e.g., expenditures in excess of the available award amount (encroachment). Districts[COEs] should record a contribution to restricted programs using Object 8980, Contributions from Unrestricted Revenues, equal to their non donor-authorized expenditures.

Line 11 - Total Expenditures

The sum of the Donor-Authorized Expenditures (Line 9) plus the Non Donor-Authorized Expenditures (Line 10).

Line 12 - Amounts Included on Line 6 Above for Prior Year Adjustments

Report the amount of the adjustments made to the current year’s revenue accounts as a result of prior year’s accounts receivable and accounts payable on this line. These adjustments should be reported as the opposite of the adjustments made on Line 6. For example, when a negative adjustment of $200 is reported on Line 6 for an adjustment for prior year’s accounts receivable, this line should show a positive adjustment of $200.

Line 13 - Calculation of Unearned Revenue or Accounts Payable, and Accounts Receivable Amounts

The sum of Line 8 minus Line 9 plus Line 12. Report this amount on Line 13a, 13b, or 13c, as applicable.

- Line 13a - When the computed amount on Line 13 is positive and the program allows for unused funds to be retained and used in the next year, report the amount on Line 13a, Unearned Revenue. The unearned revenue is the amount of categorical funds, received as of June 30, but have not been spent and, therefore, have not been earned.

- Line 13b - When the computed amount on Line 13 is positive and the program does not allow unused funds to be retained and used in the next year, report the amount on Line 13b, Accounts Payable. This amount is owed back to the grantor agency.

- Line 13c - When the computed amount on Line 13 is negative, report the amount on Line 13c, Accounts Receivable. This is the amount of revenue earned but not received from the grantor agency.

Line 14 - Unused Grant Award Calculation

The sum of the Total Available Award (Line 4) minus Donor-Authorized Expenditures (Line 9). This represents the amount of the current year’s award which has not been spent. Report this amount on Line 14 if carryover is allowed.

Line 15 - If Carryover Is Allowed, Enter Line 14 Amount Here

When carryover is allowed, enter the amount from Line 14; add this amount to the award for the next year to determine the total available award. When the award does not allow the unused funds to be carried over to the next year, enter zero. Districts should use this information in preparing the next year’s budget.

Line 16 - Reconciliation of Revenue

The sum of Line 5 plus Line 6, minus lines 13a and 13b, plus Line 13c. This line should agree with the revenue reported on the financial statements for this program. Revenue includes program revenue, Object 8990 transfers, and interest earnings.

Categorical Programs Subject to Restricted Ending Balances

Categorical programs are classified as Subject to Restricted Ending Balances when their revenue is earned at the time the funds are apportioned to the LEA. These categorical programs are generally entitlements based on an allocation formula. These programs are restricted, but more in form than in substance. Only a failure on the part of the LEA to comply with regulations causes a forfeiture of the funds. Any program funds not expended before the end of the year must be reported as Restricted Ending Balance.

The following rules apply to accounting for these programs:

- The revenue is recognized when cash is received.

- The amount of any revenue that has not been received by June 30, but is expected to be received by September 30, should be accrued as an accounts receivable.

- At the end of the year, any program funds that have not been expended are recorded as restricted ending balance. This is done because restrictions remain on the type of expenditures that can be made from the revenues; therefore, the balance for this program must be separated from the other balances available for general use.

Column Headings

Provide for each program the official name of the program, the five-digit number from the Catalog of Federal Domestic Assistance (federal programs only), the resource code used to record the program, the revenue object, and the local description of the program, if any.

AWARD

Line 1 - Prior Year Restricted Ending Balance

Report the restricted ending balance for this award as reported last year. Include adjustments made to the prior year’s award.

Line 2a - Current Year Award

Report the amount of the current year’s award. This amount should agree with the award letter or document from the grantor agency.

ine 2b - Other Adjustments

Report any other adjustments made to the award.

Line 2c - Adjusted Current Year Award

The sum of the Current Year Award (Line 2a) plus Other Adjustments (Line 2b).

Line 3 - Required Matching Funds/Other

Report the amount of required matching funds as indicated in the award letter or document. When there is no required match, enter zero. Exclude “in-kind” matching. Report other income such as interest earned by and restricted to specific programs.

Line 4 - Total Available Award

Federal The sum of the Prior Year Restricted Ending Balance (Line 1) plus the Adjusted Current Year Award (Line 2c) plus the Required Matching Funds/Other (Line 3). This amount represents the total available to be spent this year.

State/Local The sum of the Adjusted Prior Year Restricted Ending Balance (Line 1) plus the Adjusted Current Year Award (Line 2c) plus the Required Matching Funds/Other (Line 3). This amount represents the total available to be spent this year.

REVENUES

Line 5 - Cash Received in Current Year

Report the amount of the current year’s award received. Include in this amount adjustments to the current year’s revenue account as a result of the prior year’s accounts receivable.

Line 6 - Amounts Included on Line 5 for Prior Year Adjustments

Report the amount of the adjustments made to the current year’s revenue accounts as a result of the prior year’s accounts receivable on this line. These adjustments should be reported as the opposite of the adjustments made on Line 5. For example, when a negative adjustment of $200 was reported on Line 5 for an adjustment for prior year’s accounts receivable, this line should show a positive adjustment of $200.

Line 7a - Accounts Receivable

The sum of Line 2c minus Line 5 minus Line 6. This is the amount of the award for the current year that has not been received from the donor agency.

Line 7b - Noncurrent Accounts Receivable

Report the portion of Line 7a that is Noncurrent Accounts Receivable and is not expected to be received by September 30. Do not make an entry to your books for the Noncurrent Accounts Receivable.

Line 7c - Current Accounts Receivable

The sum of Line 7a minus 7b. This represents the Current Accounts Receivable portion of the award for the current year that is expected to be received by September 30. An entry should be made to your books for the Current Accounts Receivable.

Line 8 - Contributed Matching Funds

Report the amount of matching funds contributed by the district [COE]. Exclude “in kind” matching.

Line 9 - Total Available

The sum of the Cash Received in Current Year (Line 5) plus the Current Accounts Receivable (Line 7c) plus the Contributed Matching Funds (Line 8). This line should agree with the total revenue reported for this categorical program on the financial statements.

EXPENDITURES

Line 10 - Donor-Authorized Expenditures

Report the sum of the direct, direct support, and indirect costs as approved by the grantor agency; include expenditures of required matching funds. The Donor-Authorized Expenditures may not exceed the Total Available Award (Line 4).

Line 11 - Non Donor-Authorized Expenditures

Report any expenditure not authorized by the grantor agency, e.g., expenditures in excess of the available award amount (encroachment). Districts[COEs] should record a contribution to restricted programs using Object 8980, Contributions from Unrestricted Revenues, equal to their non donor-authorized expenditures.

Line 12 - Total Expenditures

The sum of the Donor-Authorized Expenditures (Line 10) plus the Non Donor-Authorized Expenditures (Line 11).

Line 13 - Restricted Ending Balance—Current Year

The sum of the Total Available Award (Line 4) minus the Donor-Authorized Expenditures (Line 10). This represents the amount of the award that has not been spent, and in most cases will agree with the ending balance reported on the financial statements for this program. When Noncurrent Accounts Receivable (Line 7b) exists, subtract that amount from the restricted ending balance calculated on this line to arrive at the ending balance reported on the financial statements. Note that prior year adjustments may necessitate an additional contribution to the restricted programs or a reverse contribution to the unrestricted programs.

Form CB—Budget Certification

Form CB is the official signature page for the budget report submission. It includes a Criteria and Standards Review Summary that recaps the Criteria and Standards, Supplemental Information, and Additional Fiscal Indicator items from the Criteria and Standards Review (Form 01CS). The Met/Not Met and No/Yes indicators in Form CB are automatically completed based on information in Form 01CS.

Criteria and Standards that are “Not Met” and supplemental information and additional fiscal indicators that are “Yes” may indicate areas of potential concern for fiscal solvency purposes and should be carefully reviewed.

Form CC—Workers’ Compensation Certification

The Workers’ Compensation Certification, Form CC, provides information about workers’ compensation claims for self insured school districts[COEs]. Form CC must be completed, signed, and included in your budget report submission whether your LEA provides this benefit.

The governing board[county board of education] shall certify to the county superintendent of schools[State Superintendent] the amount of liabilities actuarially determined and amount of total liabilities reserved in the budget (EC Section 42141). Separate categories are available for those school districts[COEs] that are members of a workers’ compensation JPA. Select the category that is most appropriate for your district[COE].

Forms CEA/CEB—Current Expense Formula/Minimum Classroom Compensation

Actuals (Required) / Budget (Optional)

The Current Expense Formula/Minimum Classroom Compensation, Form CEA/CEB, is used for the following purposes:

-

To allow county offices to determine whether the district complies with EC Section 41372, Apportionments for the Payment of Salaries of Classroom Teachers, which requires that elementary, unified, and high school districts expend at least 60, 55, and 50 percent respectively, of their current cost of education for classroom teacher and aide salaries, plus associated benefits. EC Section 41374 provides for certain school districts with individual class sessions below a certain number of pupils to be exempt from the EC Section 41372 requirements. (Enter an “X” on Line 16 of the Form CEA/CEB when your district is exempt.)

-

To report the current expense of education (EDP 365). The system will automatically generate all sections of this form except optional adjustments reported in Part I, Column 4b and Part II, Line 13b (see below for entering data on these lines).

Part I—Current Expense Formula

Calculate the current expense formula as follows:

Column 1 - Total Expense for the Year

The software extracts the data for the total expense for the year from the general ledger Fund 01 data.

Column 2 - Reductions (Note 1)

Certain expenditures should be excluded from the Current Expense of Education amount. Expenditures for Nonagency (goals 7100–7199), Community Services (Goal 8100), Food Services (Function 3700), Fringe Benefits for Retired Persons (objects 3701–3702), and Facilities Acquisition and Construction (Function 8500), which are included in Total Expense for Year (Column 1), are not included in the Current Expense of Education (Column 3). To exclude these expenditures, the software extracts into Column 2 the unduplicated expenditures in the referenced goals, functions, and objects.

NOTES:

- In addition to fringe benefits for already-retired employees, objects 3701 and 3702 may include certain allocated costs for past unfunded liabilities relating to active employees (see definitions in CSAM). All costs reported in objects 3701 and 3702 are excluded from the calculation of minimum classroom compensation.

- Maintenance Assessment District expenditures are considered to be part of the Community Services goal.

Column 4a - Reductions (Note 2—Extracted)

Certain expenditures are excluded from the Minimum Classroom Compensation calculation. Expenditures for transportation (Function 3600), lottery expenditures (Resource 1100), amounts paid to nonpublic schools for the education of special education students (Function 1180), and certain categorical aid expenditures which are included in Current Expense of Education (Column 3), are not included in Minimum Classroom Compensation and should be reported as Reductions (Column 4a).

In addition, expenditures for categorical aid programs which do not allow teacher salary expenditures or require disbursement of the funds without regard to the requirements of EC Section 41372 should be reported as Reductions (Column 4a), thereby reducing the Current Expense (Column 5). In other words, if a categorical program has, as its main purpose, activities of a specialized nature that normally indicate something other than hiring classroom teachers or aides, then the categorical funding is ignored in the minimum classroom compensation calculation (i.e., it is reduced from both the numerator and denominator of the calculation). Following are a few examples of categorical aid programs and resource codes that qualified to be excluded from the calculation:

- Broadband Infrastructure Improvement Grant (7124)

-

School Bus Emissions Reduction Fund (7236)

Following is the complete list of resource codes extracted as “reductions” in Column 4a and Line 13a: 1100, 3316, 3326, 3327, 3372, 3386, 3515, 3724, 4123, 4124, 5035, 5314, 5316, 5370, 5460, 5465, 5652, 6010, 6030, 6126, 6140, 6225, 6230, 6300, 6355, 6385, 6386, 6392, 6512, 7010, 7027, 7028, 7085, 7121, 7124, 7126, 7236, 7388, 7410, 8210, and functions 1180 and 3600.

Column 4b - Reductions (Note 2—Overrides Column 4a)

School districts may elect to report the reductions manually in Column 4b if the extracted data does not include all of the applicable categoricals.

It should rarely be necessary to use Column 4b to override the reductions automatically extracted in Column 4a. An example of the circumstances under which it is appropriate is where a district receives a grant directly from the federal government for a purpose wholly unrelated to instruction (such as developing an emergency preparedness plan), where no part of the grant can be expended for teacher salaries. Because the district receives the grant directly from the federal government, CDE has no knowledge of the grant, so CDE does not assign the grant a unique SACS resource code; the district would account for the grant using Resource 5810, Other Restricted Federal, and the grant expenditures would not automatically extract into Column 4a even though it would be appropriate for it to do so. It would be appropriate in this case for the district to use Column 4b to enter reductions that include this grant’s expenditures. The district would do this by entering in Column 4b the combined total of the reductions that were extracted in Column 4a, plus this grant’s expenditures, replacing all amounts from Column 4a.

NOTE: If an amount (even zero) is entered in any row of Column 4b, or on Line 13b (see Part II below), the software switches from using the values in Column 4a/Line 13a to using only the values in Column 4b/Line 13b; it does not use a combination of the two.

Expenditures of the Restricted Maintenance Account (RMA) (Ongoing and Major Maintenance Account, Resource 8150) should not be excluded in Form CEA. They are not “amount[s] expended from categorical aid received from the federal or state government which funds were granted for expenditures in a program not incurring any teacher salary expenditures or requiring disbursement of the funds without regard to the requirements of [EC Section 41372].”

The RMA exists to demonstrate compliance with the requirement that LEAs who receive Office of Public School Construction (OPSC) facility grants must dedicate a certain percentage of their operating budgets toward facility maintenance. Moneys contributed to this account are not federal or state categorical aid. (Note that Resource 8150 is a local resource, not a state or federal resource.) Said another way, were it not necessary to demonstrate compliance with OPSC regulations, the expenditures in the RMA account would be charged to an unrestricted resource.

Part II—Minimum Classroom Compensation

Report the classroom compensation. The software will generate all of this information except for optional adjustments reported on Line 13b.

- Line 13b: Report the salaries and benefits of teachers and instructional aides that were deducted in Column 4b (see note above in Column 4b text).

- A warning internal form check alerts users to review line 13b if no amount is entered when an amount is entered in Part I, Column 4b, Reductions (Overrides).

Part III—Deficiency Amount

Using information from Form CEA/CEB Parts I and II, Part III indicates if a school district has met the minimum classroom compensation percentage required under EC Section 41372. This information will also show on Form CA, Unaudited Actuals Certification, on the page titled Summary of Unaudited Actual Data Submission.

- If the percentage is met, Line 5 will be zero.

- If the percentage is not met, and the district has not indicated they are exempt from the requirement, Line 5 will be the amount of the deficiency. In addition, an exception will be reported in the Technical Review Checklist.

- If the district has indicated they are exempt from the requirement, Line 5 will show “exempt.”

Part IV—Explanation for adjustments entered in Part I, Column 4b

This section must be completed if an amount is entered in Part I, Column 4b, Reductions (Overrides). A fatal internal form check will generate if the required explanation is not provided.

Form DEBT—Schedule of Long-Term Liabilities

Unaudited Balance July 1

Long-term liability ending balances reported in Form DEBT in the prior year are extracted from the database into the Unaudited Balance July 1 (beginning balance) column. If long term liabilities were not reported in Form DEBT in the prior year, and, therefore, zeros appear in the beginning balance column, report any beginning balances in the Audit Adjustments/Restatements column. Data entry is not allowed in the beginning balance column.

Audit Adjustments/Restatements Column

Adjustments or restatements that increase the unaudited July 1 balances of long term liabilities are input as positive numbers. Adjustments or restatements that decrease the unaudited July 1 balances of long-term liabilities are input as negative numbers.

Audited Balance July 1 Amounts are calculated beginning with Unaudited Balance July 1, plus Audit Adjustments/Restatements.

Increases Column Increases in the amounts of long-term liabilities are input as positive numbers. The amounts in the Increases column are added to the amounts in the Audited Balance July 1 column to arrive at the Ending Balance June 30 column.

For example, the amount of general obligation bonds issued during the fiscal year is recorded on the line for General Obligation Bonds Payable, in the Increases column.

Decreases Column

Decreases in the amounts of long-term liabilities are input as positive numbers. The amounts in the Decreases column are subtracted from the amounts in the Audited Balance July 1 column to arrive at the Ending Balance June 30 column.

For example, the amount of general obligation bond principal payments made during the fiscal year decreases the balance of bonds payable, and is recorded on the line for General Obligation Bonds Payable, in the Decreases column.

Ending Balance June 30

Amounts are calculated beginning with Audited Balance July 1, plus Increases, minus Decreases.

Amounts in the Ending Balance June 30 column should be verified to ensure that adjustments, increases, and decreases to long term liabilities have been input correctly and that ending balances agree to debt schedules and financial statements. Ending balances are saved by CDE and used for external data reporting purposes and are extracted into the subsequent year’s Form DEBT as beginning balances.

Note that liabilities relating to postemployment benefits other than pensions (OPEB) are reported in two places in the SACS software. The Total/Net OPEB Liability in Form DEBT should tie to the amount reported on the Government wide Statement of Net Position. It should be expected to match the total/net OPEB liabilities reported in the Criteria and Standards Review.

Amounts Due Within One Year

Amounts of long-term liabilities due within one year are input as positive numbers. The amounts in this column represent the portion of the long-term liabilities reported in the Ending Balance June 30 column that are payable in the next fiscal year. The amount reported as due within one year should not exceed the ending balance of the associated liability. If it does exceed the ending balance, “At least one Amount Due exceeds Ending Balance” will appear in red on the screen and will also appear on the printed report. Upon closing the form, a message will display requesting that the data be input or corrected as appropriate. If the condition is not cleared, a technical review check (TRC) exception will occur the next time the Export TRCs are run.

Form ESMOE—Every Student Succeeds Act Maintenance of Effort

This form compiles the expenditures to be used in determining when a local educational agency (LEA) met the maintenance of effort requirement under the Elementary and Secondary Education Act (ESEA), as reauthorized by the “Every Student Succeeds Act (ESSA)”. It is required for LEAs that received funding under covered programs, as indicated by having revenue account balances for applicable resource codes.

This form must be completed and saved during the unaudited actuals period, when applicable, or a Fatal exception will display in the supplemental technical review checks. In all other periods, this form is optional and is provided for planning purposes only. For the unaudited actuals period, form ESMOE extracts unaudited actual data. For the budget and interim periods, form ESMOE extracts estimated actual and projected year totals data, respectively.

This form is optional for interim periods.

MOE Requirement

The ESEA, as reauthorized by ESSA, provides that an LEA may receive funds under a covered program for any fiscal year only when the state educational agency finds that its state and local funded expenditures for free public education in the preceding fiscal year is not less than 90 percent of those in the second preceding fiscal year, in the aggregate or on a per capita expenditure basis (20 USC 7901; ESEA Sec. 8521). This is to ensure that funds under covered programs are used to provide services that are in addition to the regular services provided by the LEA to participating children. Under certain circumstances, an LEA may obtain a waiver. The MOE test is done at the LEA level.

Failure to Meet MOE

Absent a waiver, an LEA’s failure to meet the MOE requirement applicable to a particular funding year may result in a reduction of allocations under the covered programs for that year. The list of covered programs may be found in Section 8101(11) of the ESEA. CDE will reduce the allocations in the exact proportion by which the LEA failed to meet the MOE requirement by falling below 90 percent of both the combined fiscal effort per student and aggregate expenditures, using the measure most favorable to the LEA, if such LEA has also failed to meet such requirement for one or more of the five immediately preceding fiscal years (20 USC 7901; ESEA Sec. 8521(b)(1)). This reduction is equal to the allocation amount times a “deficiency” percentage based on aggregate expenditures or per capita expenditures, whichever is less. The deficiency percentage is equal to the amount in the preceding year that is below the required level of effort, i.e., 90 percent of the second preceding year’s aggregate expenditures or per capita expenditures, divided by that required level of effort.

If the actual aggregate and per capita expenditures for a particular year do not meet the required level of effort, they shall not be used as the basis for determining MOE in subsequent years; the basis will be the required level of effort for that year.

NOTE: Form ESMOE provides the LEA a preliminary determination as to whether it met the MOE requirement for a particular funding year. The target date for completion of the official MOE test done by CDE is April 30 of the fiscal year prior to the funding year to which the test applies. LEAs that fail the test are normally notified by July that their funding for covered programs for the fiscal year beginning in July will be reduced as described above. As such, the MOE test for funding year 2023–2024, comparing 2021–22 expenditures with those for 2020–21, are completed by April 30, 2023. LEAs that fail that test are notified of the result by July 31, 2023, and their funding for covered programs for 2023–24 are reduced accordingly.

Completing Form ESMOE

The amounts in sections I, II, and III are usually extracted and calculated; manual entry is only allowed for lines I.C9 and I.D2 when applicable. In Section IV, manual entry is allowed for any base expenditure adjustment to the extracted data in Section III. Detail below reflects the unaudited actuals period which compares 2021–22 expenditures to 2020–21 expenditures. Interim periods compare projected 2022–23 expenditures with 2021–22 unaudited actuals expenditures.

Section I—Expenditures

Lines A, B, and C1 C8 2021–22 Expenditures—Total and Exclusions

These amounts are extracted from the unaudited actual general ledger data, for the funds, goals, functions, and objects as indicated on the form.

Line A is the total state, local, and federal expenditures for the LEA.

Lines B and C1 through C7 are excluded from the total expenditures shown on Line A, since they are not for free public education for MOE calculation purposes, as provided under 34 CFR Section 299.5.

Line C8 - Tuition, a revenue account, is deducted from the total expenditures on Line A to account for the reduction of expenditures resulting from tuition reimbursement. This line also includes amounts received by County Offices from districts for district students in programs operated by the county office.

Line C9 - Supplemental Expenditures for Presidentially Declared Disaster

Enter on Line C9 any expenditures resulting from a Presidentially declared disaster included in the total expenditures on Line A but not included on lines B, C1 C8, D1, or D2. These are not subject to MOE, as prescribed under 34 CFR Section 299.5.

Lines D1 D2 - Additional MOE Expenditures

Line D1 is extracted and is the difference between the cafeteria fund expenditures and revenues, representing any deficit spending in the cafeteria program. Net expenditures to cover deficits for food services are part of the expenditures subject to MOE.

Enter on Line D2 any expenditures to cover deficits for student body activities, which are also part of the expenditures subject to MOE.

Line E - Total Expenditures Subject to MOE

This line is the total expenditures subject to MOE and will be the base in determining if the LEA maintained the required level of expenditures on an aggregate expenditures basis (90 percent of Line E).

Section II—Expenditures Per ADA

Line A- Average Daily Attendance

This is the total elementary and high school, including charter schools, ADA for the 2021–22 Annual Report, extracted from Form A, Average Daily Attendance. For budget periods, ADA is extracted from the Estimated Annual ADA column of Form A. For interim periods, Annual ADA is not available on Form AI, so ADA is extracted from the Estimated P-2 Report ADA Projected Year Totals column (District) or Form AI Estimated Funded ADA Projected Year Totals column (County). Because manual adjustment may be required to accurately reflect estimated Annual ADA, this extracted ADA number may be overwritten.

Line B - Expenditures Per ADA

This is the per capita expenditures for MOE purposes, arrived at by dividing Total Expenditures Subject to MOE (Line I.E) by Average Daily Attendance (Line II.A). It is the base in determining if the LEA maintained the 90 percent required level of expenditures on a per capita basis.

Section III — MOE Calculation

This calculation determines whether the LEA met the MOE requirement. This is a preliminary determination only, as the final determination is made by the CDE based on the SACS data submitted by the LEAs, which are subject to CDE review.

Line A - Line A, Base Expenditures

For the budget and unaudited actuals periods, the total (aggregate) and total per ADA (per capita) base expenditures are preloaded from the official CDE prior year MOE calculation. Note that for submissions in the Budget period, preloaded base figures are preliminary because the official CDE calculation may not be complete; amounts are provided for planning purposes only and may be overwritten, if necessary.

For interim periods (all LEAs), base expenditures are extracted and preloaded from the prior year (2021–22) unaudited actuals period form (Section III, Line C). These amounts may be overwritten, if necessary.

LEAs who failed the MOE requirement:

The required effort for 2021–22 is 90 percent of the MOE expenditures for 2020–21. The exception to this rule is when the LEA does not meet its required effort in the prior year (2020–21). In this instance, the LEA’s 2021–22 base expenditure amount is 90 percent of the preceding prior year (2019–20) expenditure amount (or required expenditure amount when the LEA also failed MOE in 2019–20). Please note that data preloaded from the official CDE calculation for county and district budget and unaudited actuals periods reflects the adjusted base expenditure amount for LEAs that failed the prior year MOE calculation. However, for interim period calculations (projecting the estimated outcome of the MOE calculation for the 2022–23 unaudited actuals period), LEAs must manually make adjustments to their preloaded base expenditure amounts when they failed the MOE calculation in 2021–22. Interim preloaded amounts are extracted directly from the previous appropriate preliminary calculation, therefore adjustments have not been made to reset the base to the required expenditure level. LEAs must utilize Section IV to adjust their Base Expenditures (Line III.A). The Adjusted Base Expenditures on Line III.A2 should equal 90 percent of the 2020–21 aggregate and per ADA expenditures.

Line A1 - Adjustments to Base Expenditures

This amount is from Section IV and is for adjustments to the LEA’s total or per ADA base expenditures for LEAs who fail the prior year MOE requirement. See Section IV instructions for an explanation of how this line should be utilized.

Line A2 - Adjusted Base Expenditures

This is the sum of lines A and A1, and is the amount on which the total and per capita 2021–22 required effort is based.

Line D - MOE Deficiency Amount, if Any, Expressed in Total and Per ADA Expenditures

This is the difference between Line B, required effort, and Line C, current year expenditures, for total expenditures and per capita. When one or both columns show a zero, the MOE requirement is met; when both are positive (Line C is less than Line B), the current year expenditures are less than the required fiscal effort, and the MOE requirement is not met.

Line E - MOE Determination

This line shows a message that indicates whether the MOE is met, or when the MOE calculation is incomplete. When the message is that the MOE calculation is incomplete, this indicates that data required to calculate the MOE deficiency amount on Line III.D is absent. When general ledger data has been imported and Form A is completed, it may be necessary to make adjustments in Section IV to complete the data.

Line F - MOE Deficiency Percentage, When MOE Not Met; Otherwise Zero

These are calculated amounts and the percentages by which the LEA failed to meet the MOE in 2021–22. When an LEA failed the MOE requirement comparing the 2021–22 expenditures with the required effort for that year, the amount of funding for MOE covered programs for 2023–24 may be reduced by the lower of the total expenditures or per ADA deficiency percentage shown on this line, subject to CDE review.

Section IV—Detail of Adjustments to Base Expenditures

List in this section adjustments to the LEA’s base expenditures. This section is used for interim periods by LEAs who failed the MOE requirement in the preceding year and need to use their second preceding year’s expenditure data as their base expenditures. To make an adjustment, enter the exact amounts that display on Line III.A as negative numbers on the first adjustment line in Section IV so Line III.A2 equals zero. Then, add a line in Section IV and, using your 2020–21 Form ESMOE for reference, enter 90 percent of the final total expenditure amount into the Total Expenditures column and enter 90 percent of the final total expenditures per ADA amount into the Expenditures Per ADA column.

A description of adjustments must be provided for validation purposes. For the unaudited actuals period, an internal form check prompts users to enter the description of adjustments in the Expenditure Adjustment column or the ADA Adjustment column. Users may close the form without fixing the condition, but the reason for the adjustment must be provided to complete an official export.

After completing this form, click Save and close the window. This will prevent a Fatal exception in the TRCs.

Form GANN—Appropriations Limit Calculations

In November 1979, California voters approved Proposition 4, an initiative that added Article XIII B to the California Constitution. This constitutional amendment, popularly known as the Gann Initiative, placed limits on the growth of expenditures for publicly funded programs. Division 9 of Title 1, beginning with Section 7900 of the Government Code, was then added to law to specify the process for calculating state and local government appropriation limits and appropriations subject to limitation under Article XIII B of the Constitution. These constitutional and statutory sections explain and define the appropriations limit and appropriations subject to limitation as they apply to state and local governments and require that each entity of government formally “adopt” its appropriations limit for a given fiscal year.

In addition, Education Code sections 1629 and 42132 specify that by September 15 (districts) and October 15 (county offices of education) of each year, the governing boards of districts and county offices of education shall adopt a resolution identifying their estimated appropriations limits for the current year and their actual appropriations limit for the preceding year. The documentation supporting the adoption resolution shall be made available to the public. It is not necessary to submit a copy of the board resolution adopting your appropriations limit to the CDE.

For further information or any questions about the Gann program, please contact the CDE Government Affairs Division at gann@cde.ca.gov.

Form GANN was implemented to assist LEAs in meeting their constitutional and statutory obligations under the Gann Initiative to calculate appropriation limits and appropriations subject to limitation. Districts and county offices of education must include their completed Form GANN with their officially exported unaudited actual submission.

Upon opening Form GANN, applicable general ledger, attendance, and revenue data is extracted into the form. The general ledger account codes and specific forms from which data is extracted are noted on the form. In addition, applicable prior year Gann data as reported in the prior year’s Form GANN will be preloaded into the form. Once the extractions are completed, only a few items remain to be keyed into the form.

Adjustment columns are available to make any necessary corrections to preloaded or extracted data, for compliance with Gann reporting requirements. All adjustments must be explained in the bottom section of Form GANN, and documentation supporting the adjustments kept in your files along with a copy of this year’s Form GANN.

A fatal internal form check will prompt users to enter an explanation if data exists in the Adjustments column. Users will be able to close the form without fixing the condition, but the explanation must be provided to complete an official export.

The first set of columns on Form GANN, 2021–22 Calculations, calculate the 2021–22 appropriations limit and appropriations subject to the limit, and the second set of columns, 2022–23 Calculations, calculate the 2022–23 preliminary appropriations limit and that year’s appropriations subject to the limit. The references in the columns such as “2021–22 Actual” or “2022–23 Budget” refer to columns on the source documents (Form A) or the type of general ledger data (actual or budget) being extracted into Form GANN.

School Districts

Section A—Prior Year Data

2020–21 Gann data from the 2020–21 Form GANN is preloaded into the form and includes any charter school data included in the report. If any data is incorrect or missing, please contact the Office of Financial Accountability and Information Services at 916-322-1770 or sacsinfo@cde.ca.gov.

Line 1 - Final Prior Year Appropriations Limit

Line A1 in the 2021–22 Calculations, Extracted Data column is preloaded from Line D11 in the 2020–21 Calculations, Entered Data/Totals column of the 2020–21 Form GANN. The amount in the 2022–23 Calculations, Entered Data/Totals column is from Line D11 in the 2021–22 Calculations, Entered Data/Totals column at the end of this form.

Line 2 - Prior Year Gann ADA

Line A2 in the 2021–22 Calculations, Extracted Data column is preloaded from Line B3 in the 2020–21 Calculations, Entered Data/Totals column of the 2020–21Form GANN. The amount in the 2022–23 Calculations, Entered Data/Totals column is from Line B3 in the 2021–22 Calculations, Entered Data/Totals column of this form.

NOTE: If ADA or any revenue items included in the 2020–21 Gann limit calculation is adjusted after you submitted your 2020–21 unaudited actuals to CDE, then you must recalculate the 2020–21 appropriations limit. After recalculating the appropriations limit, determine and enter the adjustments in the Adjustments column for lines A1 and A2 in this year’s Form GANN in order to reflect the correct 2020–21 Appropriations Limit and ADA in the Entered Data/Totals column. The amounts entered in the Adjustments column require an explanation on the bottom of Form GANN. You must keep a copy of the revised calculations in your files along with this year’s calculations. If an adjustment is entered on Line A2 but not on Line A1, a message will display in red above Line A1 and, upon closing the form, a message will display. In addition, a fatal Export technical review check exception will appear upon running the export TRCs that must be corrected before you may officially export your data.

Lines 3-6 - Adjustments to Prior Year Limit

On Line A3, enter the amount of adjustments to prior years’ appropriations limits to reflect district lapses, reorganizations, and transfers of responsibility where a transfer of appropriations limit authority occurred between the district and another LEA that is not in direct proportion to the ADA transferred. Enter adjustments to the 2020–21 limit in the 2021–22 Entered Data/Totals column, and adjustments to the 2021–22 limit in the 2022–23 Entered Data/Totals column.

On Line A4, enter the amount of any voter approved increases to 2020–21 appropriations limit in the 2021–22 Entered Data/Totals column, and increases to the 2021–22 limit in the 2022–23 Entered Data/Totals column. Increases are usually associated with the approval of a parcel tax or some other increase in tax revenues and are only valid for four years, at which time the appropriations limit must be adjusted downward to the level it would have been had the increases not been approved.

On Line A5, enter the effect of the lapse of a voter approved increase to 2020–21 appropriations limit in the 2021–22 Entered Data/Totals column, and the effect to your 2021–22 limit in the 2022–23 Entered Data/Totals column (see description for Line A4 above). This amount will be subtracted from lines A3 and A4 to calculate the total adjustments to the 2020–21 and 2021–22 appropriations limits on Line A6.

Line 7 - Adjustments to Prior Year ADA

On Line A7, enter the adjustments to the prior year ADA resulting from district lapses, reorganizations, and other transfers, only when an adjustment to the district’s appropriations limit is entered on Line A3 above.

Section B—Current Year Gann ADA

Lines 1-3 - Current Year P-2 ADA (From Form A)

Total K-12 ADA and Total Charter Schools ADA from the 2021–22 Unaudited Actuals P-2 ADA and 2022–23 Budget Estimated P-2 ADA columns of Form A are extracted into the respective Extracted Data columns. Adjustments to those amounts may be entered into the Adjustments columns to meet Gann reporting requirements but must be explained in detail on the bottom of Form GANN.

Section C—Current Year Local Proceeds of Taxes / State Aid Received

Lines 1-16 - Taxes and Subventions (From Funds 01, 09, and 62)

General Fund, Charter Schools Special Revenue Fund, and Charter Schools Enterprise Fund data for unaudited actuals year 2021–22 and budget year 2022–23 is extracted into the respective Extracted Data columns. Adjustments to those amounts can be entered into the Adjustments columns to meet Gann reporting requirements but must be explained in detail on the bottom of Form GANN.

Line C13, Other Non-Ad Valorem Taxes—When necessary, enter an amount in the Adjustments column to adjust the extracted amount to account for tax revenues (excluding voter approved debt service taxes) that are subject to the appropriations limit. Non-tax amounts should not be included here. Enter an explanation on the bottom of Form GANN.

Line C14, Penalties and Interest from Delinquent Non LCFF Taxes—When necessary, enter an amount in the Adjustments column to adjust the extracted amount to account for those penalties and interest for the above taxes. Do not include penalties and interest on other local taxes or revenues (e.g., penalties and interest on debt service taxes). Enter an explanation on the bottom of Form GANN.

Line C15, Transfers to Charter Schools in Lieu of Property Taxes (Object 8096). The adjustment for Transfers to Charter Schools in Lieu of Property Taxes (negative in virtually all districts) was eliminated beginning in 2016–17. The reason for the change is that the previous treatment of the in-lieu transfers did not capture taxes that were transferred to charter schools that report separately in SACS or that report their financial data on the Charter School Alternative form. These tax funds are subject to the appropriations limit requirements and should not be excluded from the calculations.

Lines 17-18 - Other Local Revenues (From Funds 01, 09, and 62)

General Fund, Charter Schools Special Revenue Fund, and Charter Schools Enterprise Fund data for unaudited actuals year 2021–22 and budget year 2022–23 is extracted into the respective Extracted Data columns. Adjustments to those amounts can be entered into the Adjustments columns to meet Gann reporting requirements but must be explained in detail on the bottom of Form GANN.

Lines 19-23 - Excluded Appropriations

Lines C19 through C22 require manual input, with the exception of C19c.. Include appropriations made directly or indirectly from local proceeds of taxes reported on lines C18 and D7b, or from state aid received reported on Line C26.

On Line C19a, enter expenditures in funds 01, 09, and 62, objects 3301 and 3302, for federally mandated Medicare. Do not include employer contributions to Medicare that are not mandated by the federal government, such as those resulting from negotiated employee contracts or other decisions by the LEA. Do not include contributions for OASDI or for alternative retirement plans. If no federally mandated Medicare contributions are made, enter zero. **If no amount is entered on this line, a warning message will display above the line and in a message box upon closing the form.**

On Line C19b, enter expenditures for any qualified capital outlay projects, which is defined as fixed assets (including land and construction) with a useful life of 10 or more years and a value which equals or exceeds one hundred thousand dollars ($100,000). Only include expenditures that are made from local proceeds of taxes reported on lines C18 and D7b, or from state aid received reported on Line C26.

On Line C19c, data is preloaded with data extracted from a district's general ledger for Fund 01, Resource 8150, Objects 8900-8999. If necessary, enter an amount in the Adjustments column to adjust the extracted amount to only account for deposits made from local proceeds of taxes reported on lines C18 and D7b, or from state aid received reported on Line C26, into a routine restricted maintenance account. Enter an explanation on the bottom of Form GANN.

On Line C20, enter the amounts that represent expenditures required by the Americans with Disabilities Act federal law that are not reimbursed by federal, state, or other sources and which are made from local proceeds of taxes reported on lines C18 and D7b, or from state aid received reported on Line C26.

On Line C21, enter the amounts that represent expenditures required by court order for desegregation costs for which the district has not received reimbursement from the state and which are made from local proceeds of taxes reported on lines C18 and D7b, or from state aid received reported on Line C26 (for court orders imposed on or after November 6, 1979).

On Line C22, enter the amounts that represent other expenditures required by court or federal mandates imposed on or after November 6, 1979, that are not reimbursed by the state or other sources and which are made from local proceeds of taxes reported on lines C18 and D7b, or from state aid received reported on Line C26.

Lines 24-26 - State Aid Received (From Funds 01, 09, and 62)

General Fund, Charter Schools Special Revenue Fund, and Charter Schools Enterprise Fund data for unaudited actuals year 2021–22 and budget year 2022–23 is extracted into the respective Extracted Data columns. Adjustments to those amounts may be entered into the Adjustments columns to meet Gann reporting requirements but must be explained in detail on the bottom of Form GANN.

Line C24 includes LCFF funding received via the Principal Apportionment (Object 8011), plus funding received from the Proposition 30 Education Protection Account (Object 8012), created as a result of voter approval on November 6, 2012.

Line C25, LCFF/Revenue Limit State Aid-Prior Years (Object 8019). Included on this line are prior year adjustments/corrections to LCFF/Revenue Limit State Aid. Also included on this line are prior year corrections for programs previously funded through the Principal Apportionment that are now part of the LCFF entitlement. This would include prior year funding for Supplemental Instruction, ROC/P, Community Day School Additional Funding, Charter School General Purpose, and Charter School Block Grant funding.

Lines 27-28 - Data for Interest Calculation (From Funds 01, 09, and 62) General Fund, Charter Schools Special Revenue Fund, and Charter Schools Enterprise Fund data for unaudited actuals year 2021–22 and budget year 2022–23 is extracted into the respective Extracted Data columns to calculate the amount of interest that is to be counted in the LEA’s appropriations limit. Adjustments to those amounts can be entered into the Adjustments columns to meet Gann reporting requirements but must be explained in detail on the bottom of Form GANN.

Section D—Appropriations Limit Calculations

This section requires no extractions or entered data; it is calculated based on the data in sections A, B, and C.

Lines 1-4 - Preliminary Appropriations Limit equals the revised prior year appropriations limit times the inflation factor (based on price factor published by the Department of Finance) times the program population adjustment (change in ADA factor).

Lines 5-9d - Appropriations Subject to the Limit equals the district’s local revenues plus state subventions less excluded appropriations.

Line 10 - Adjustments to the Limit Per Government Code Section 7902.1

If there is an amount greater than zero in this field (i.e., your appropriations subject to the limit exceed your preliminary appropriations limit), your limit has increased. If there is an amount less than zero in this field (i.e., your preliminary appropriations limit exceeded your appropriations subject to the limit), your limit has decreased.

Gann Contact Information

The Gann Contact Person and the Contact Phone Number must be completed in order to do an Official export. If the contact information is not completed, a message box stating such will display upon closing the form. In addition, the export technical review check GANN-PROVIDE will not pass.

County Offices of Education

Section A—Prior Year Data

2020–21 Gann data from the 2020–21 Form GANN is preloaded into the form and includes any charter school data included in the report. When data is incorrect or missing, please contact the Office of Financial Accountability and Information Services at 916-322-1770 or sacsinfo@cde.ca.gov.

Lines 1-3 - Prior Year Appropriations Limit

Line A1 in the 2021–22 and 2022–23 Calculations, Extracted Data columns are equal to A3 (the prior year final appropriations limit) times the percentage the LCFF alternative education grant is to the total of the LCFF alternative education plus operations grants, but not to exceed the LCFF alternative education grant. The percentage is calculated using A6 and A7.

Line A2 in the 2021–22 Calculations, Extracted Data column is equal to the difference between lines A3 and A1.

Line A3 is the final prior year appropriations limit and is preloaded from Line D16 in the 2020–21 Calculations, Entered Data/Totals column of the 2020–21 Form GANN. The amount in the 2022–23 Calculations, Entered Data/Totals column extracts from Line D16 in the 2021–22 Calculations, Entered Data/Totals column at the end of this form.

There was a change in 2016–17 in the calculation of the portion of the appropriations limit attributable to direct services to students versus the portion attributable to other services. The purpose of the change is to readjust the split between the categories to mirror the actual split occurring in LCFF calculations.

Lines 4-5 - Prior Year Gann ADA

Line A4 in the 2021–22 Calculations, Extracted Data column is preloaded from Line B3 in the 2020–21 Calculations, Entered Data/Totals column of the 2020–21Form GANN. The amount in the 2022–23 Calculations, Entered Data/Totals column is from Line B3 in the 2021–22 Calculations, Entered Data/Totals column of this form.

**Line A5 in the 2021–22 Calculations, Extracted Data column is preloaded from Line B4 in the 2020–21 Calculations, Entered Data/Totals column of the 2020–21 Form GANN. The amount in the 2022–23 Calculations, Entered Data/Totals column is from Line B4 in the 2021–22 Calculations, Entered Data/Totals column of this form.